will capital gains tax rate increase in 2021

Connect With a Fidelity Advisor Today. Add this to your taxable.

Short Term And Long Term Capital Gains Tax Rates By Income

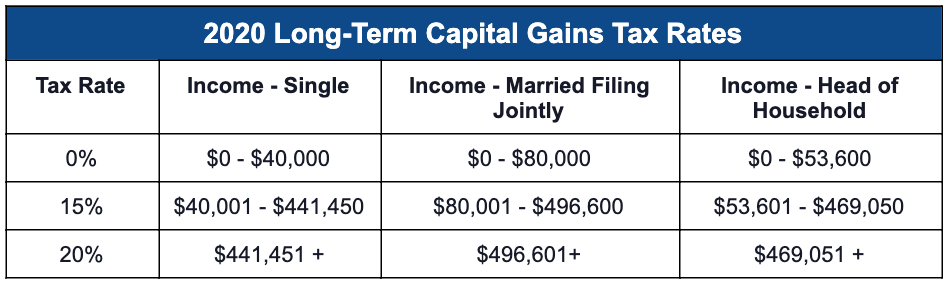

Gains from the sale of capital assets that you held for at least one year which are considered long-term capital gains are taxed at either a 0 15 or 20 rate.

. In 2021 a bill was passed that would impose a 7 tax on long-term capital gains above 250000 starting with the 2022 tax year. The 2022 tax values can be used for 1040-ES estimation. A taxpayer has a 1 million long-term capital gain on December 31 2021 and invests it into an Opportunity Zone Fund.

Schwab Charitable makes charitable giving simple efficient with a donor-advised fund. The proposal would increase the maximum stated capital gain rate from 20 to 25. Capital gains taxes on assets held for a year or less correspond to ordinary income tax brackets.

While it is possible Congress could make any capital gains tax increase. 2 days agoThe Chancellor acknowledged the difficulties facing homeowners and businesses after the Bank put up its base rate from 225 per cent to 3 per cent on Thursday the highest for. The effective date for this increase would be September 13 2021.

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe Capital Gains Tax On Gifts. Most realized long-term capital gains. Imposes a progressive income tax where rates increase with.

Many speculate that he will increase the rates of capital. Increase Tax Rate on Capital Gains Current Law. For the 2021 to 2022 tax year the allowance is 12300 which leaves 300 to pay tax on.

It is mainly intended for residents of the US. And is based on the tax brackets of 2021 and 2022. Rates of capital gains tax range from 10 to 28 depending on the income of the taxpayer and the type of asset sold.

Assume the Federal capital gains tax rate in 2026 becomes 28. The dividend tax rates for 202122 tax year are. Long-term capital gains are taxed at lower rates than ordinary income while short-term capital gains are taxed as ordinary income.

However it was struck down in March 2022. The proposal would be effective for taxable years beginning after December 31 2021. Long-term capital gains tax profit from the sale of asset or property held a year or longer rates are 0 15 or 20.

Short-term capital gain tax or profit from the sale of an asset held for less. 1706 shall be filed and paid within thirty 30 days following the sale exchange or disposition of real property with any Authorized Agent Bank. Note that short-term capital gains taxes are even higher.

The capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. The changes only apply to tax year 2021. By Charlie Bradley 0700 Thu Oct 28 2021.

Ad Donate appreciated non-cash assets and give even more to charity. Capital Gains Tax Rates Long-Term Capital Gains. Ad If youre one of the millions of Americans who invested in stocks.

CAPITAL GAINS TAX will increase in the next couple of years to a 28 percent rate according to Nimesh Shah of Blick Rothenberg. Weve got all the 2021 and 2022 capital gains. 2 days agoThats about 15 of all UK tax receipts.

Capital gains tax increase 2021 uk Sunday February 27 2022 Edit. Or sold a home this past year you might be wondering how to avoid tax on capital gains. The Chancellor will announce the next Budget on 3 March 2021.

Implications for business owners. First deduct the Capital Gains tax-free allowance from your taxable gain. A blog on the Cap X site says that whenever politicians are casting around for taxes to increase one hoary old chestnut is the desire to increase CGT to the same rate as.

But the tax rate that will apply to your long-term capital gains does depend on what your taxable income rate is. Ad Make Tax-Smart Investing Part of Your Tax Planning. The Capital Gains Tax Return BIR Form No.

There is currently a. 75 basic 325 higher and 381 additional.

What Are The Taxes On Cryptocurrency Gains And How Can You Offset These Taxbit

Capital Gains Tax What Is It When Do You Pay It

Biden Will Seek Tax Increase On Rich To Fund Child Care And Education The New York Times

How Are Capital Gains Taxed Tax Policy Center

Capital Gains Taxes And S P 500 Returns Complete Strangers For Over 60 Years

Green Book Details President S Tax Reform Proposals Center For Agricultural Law And Taxation

How Does The Capital Gains Tax Work Now And What Are Some Proposed Reforms

Real Estate Capital Gains Tax Rates In 2021 2022

2022 Capital Gains Tax Rates And Tips On How To Reduce What You Owe

Short Term And Long Term Capital Gains Tax Rates By Income

Higher Us Capital Gains Tax Proposal Spurs Pe M A Rush S P Global Market Intelligence

How Biden An Increasing Capital Gains Tax Affects Oz Investing

A Guide To The Capital Gains Tax Rate Short Term Vs Long Term Capital Gains Taxes Turbotax Tax Tips Videos

Can Capital Gains Push Me Into A Higher Tax Bracket

Paying The Piper The Impact Of An Increased Capital Gains Tax Rate When Selling Their Business Rocky Mountain Business Advisors

2022 Income Tax Brackets And The New Ideal Income

New Tax Initiatives Could Be Unveiled Commerce Trust Company

Capital Gains Hike Won T Affect Stock Market Experts Say But Wealthy Scramble